LEVERAGE & OTHER CFD PRODUCTS CHANGES

Effective from 1st Aug 2018

(“ESMA Measures”)

The regulatory landscape is changing; European regulator (ESMA) announced CFD products’ measures which will come in to the effect from 1st August 2018. ESMA’s official decision about the product restriction measure could be found in different languages via ESMA website here.

This page provides a brief summary of ESMA Measures, FAQ, professional and retail clients terms comparison and pros and cons should you apply and qualify to be a professional client including protections you may lose.

How will Clients be affected?

TeraFX has permissions to accept three types of clients: retail, professional and eligible counterparties. On your application to open an account with TeraFX you are classified appropriately as per our Classification Policy. Professional client or TeraFX Pro Account has the same meaning for the purpose of this notice.

Retail Clients of TeraFX will be impacted by ESMA measures. CFDs leverage restrictions to be imposed on new opened positions on or after 1st August 2018 won’t apply to professional traders (see also table below).

There are other ESMA measures except leverage, which affect retail clients such as 50% margin close out rule on an account level basis, negative balance protection on an account level basis and restriction on the incentives (no monetary and non-monetary benefits).

Remember we will always inform you separately about protections you may lose should you apply and qualify to be professional client. Please read the criteria to qualify to ascertain whether you would like to apply become a Professional Client.

AM I ELIGIBLE FOR A TeraFX Pro ACCOUNT?

To be eligible for a TeraFX Pro account, you need to meet the professional client eligibility criteria. If you answer yes to two of these three questions, you could be eligible for a Pro account.

Eligibility criteria

- Have you placed 10 relevant trades of a significant size per quarter in the last year?

- Does your financial instrument portfolio exceed €500,000 or currency equivalent?

- Do you, or have you, worked in the financial sector requiring knowledge of the CFD transactions for at least 1+ year(s)?

View qualification criteria in detail

TALK TO US

Any questions about TeraFX pro account?

Call us on: 020 70730493

E-mail: customerservices@terafx.co.uk

Professional Client vs Retail Client Comparison

* Please email customerservices@terafx.co.uk for availability and details

*Professional Clients also:

Remain eligible for the Financial Services Compensation Scheme if you are a natural person. Retain the rights to complain to the Financial Ombudsman Service when trading in a personal capacity. Please note TeraFX is not obliged to segregate professional clients’ money but we may choose to do so upon your written request.

Professional Client Status Details

It is important that you understand exactly how a Professional Client will be treated differently to a Retail Client should you wish to apply for Professional Client status:

| UNCHANGED PROTECTIONS | WAIVED PROTECTIONS |

|---|---|

|

We are not obliged to offer the following to Professional Clients but have elected to continue doing so: Best Execution remains unchanged as we owe all our clients a duty of best execution. The detail of Trade Confirmations remain unchanged and are sent by the end of the first business day following the execution of the trade, or earlier. Key Information Documents remain available to you. You will remain eligible for the Financial Services Compensation Scheme (FSCS) if you are a natural person. You will retain the rights to complain to the Financial Ombudsman Service when trading in a personal capacity. |

You will waive some FCA protections: Margin and Leverage Limits remain unchanged despite the changes that ESMA introduce for retail clients. Your client money will not be segregated from our funds. You, however, can request the segregation and we will consider your request. Mandatory changes to product features which protect retail clients will not be mandatory for you. (e.g. negative balance protection and margin close out levels). We will assume you have the relevant knowledge and experience levels to understand the risks in trading leveraged products. We may use more sophisticated language when dealing with you as a Professional Client than we do with our retail clients. |

Margin Requirement Examples

The table below shows you how the new leverage limits will affect the margin required to open a position after 1st of Aug 2018:

| Symbol | Trade size | Contract size | Margin required for Professional Clients (for 500:1 account leverage**) | Margin required for Retail Clients |

|---|---|---|---|---|

| GBPUSD! | 1 CFD | GBP100,000 | £220 | £3,333 (30:1) |

| D30EUR! | 1 CFD* | EUR1 | £37.3 | £564.5 (20:1) |

|

*opening price 12905.15 |

||||

TALK TO US

Any questions about TeraFX pro account?

Call us on: 020 70730493

E-mail: customerservices@terafx.co.uk

Not eligible for TeraFX Pro Account?

TeraFX is a regulated broker and adheres to EU and UK regulations for retail clients’ protection.

Although reduced leverage from 1st Aug 2018 will apply, you as a retail client of TeraFX can still trade variety of CFDs via one of the best regarded platforms on the market - MT4. You will also have retail clients’ protections, to include:

- 50% margin close out rule on an account level basis,

- negative balance protection on an account level basis

- client money segregation.

Key ESMA changes for Retail Clients

Limits on leverage

Leverage limits will be reduced

Margin close out

Mandatory 50% margin close out rule

Negative balance protection

Trade with reduced risk

What will happen to my account after 1st of August 2018

Positions opened before 1st August 2018 (retail client)

In order to act in the best interest of its clients, TeraFX will maintain existing positions of its retail clients opened before the 1st of August 2018 on current leverage until such positions are closed by each respective client (“Existing positions”). Retail clients’ positions opened on or after the 1st of August 2018 will be opened with new leverage levels in compliance with the Measures (“New positions”). In addition, TeraFX will maintain stop out levels as they are currently for Existing positions; for New positions, TeraFX will set a stop out level at 50%.

Existing positions will be close-only starting from 1 Aug, implying that clients will only be able to close their existing positions but will not be able to open new positions with the existing symbols.

Positions after 1st of August 2018 (retail client)

New symbols will be defined in the system. Starting from 1 Aug, all new positions will be traded with new symbols. We will add “!” to each symbol to indicate it is a new symbol in compliance with new ESMA leverages (such as EURUSD symbol will be EURUSD!).

There could be slight changes to mark ups as security groups will change along with new symbols and new leverages. Clients are encouraged to email customer services to learn their new mark ups based on new security groups, compared to old mark ups.

A new account will be opened for you if you are active client (have positions opened). New symbols and leverages will be defined into new accounts. We will share account login information at the end of July. Clients will be able to maintain and close their positions opened before 1 Aug in their old accounts and will be able to open new positions with new symbols after 1 Aug in their new accounts.

All inactive accounts (accounts with no open positions) will be changed to read-only as of 31 July 2018.

If your account was inactive (no open trade) but after 1st August 2018 you wish to trade with new leverages and new symbols we encourage you to send an email to customerservices@terafx.co.uk to initiate and speed up the process.

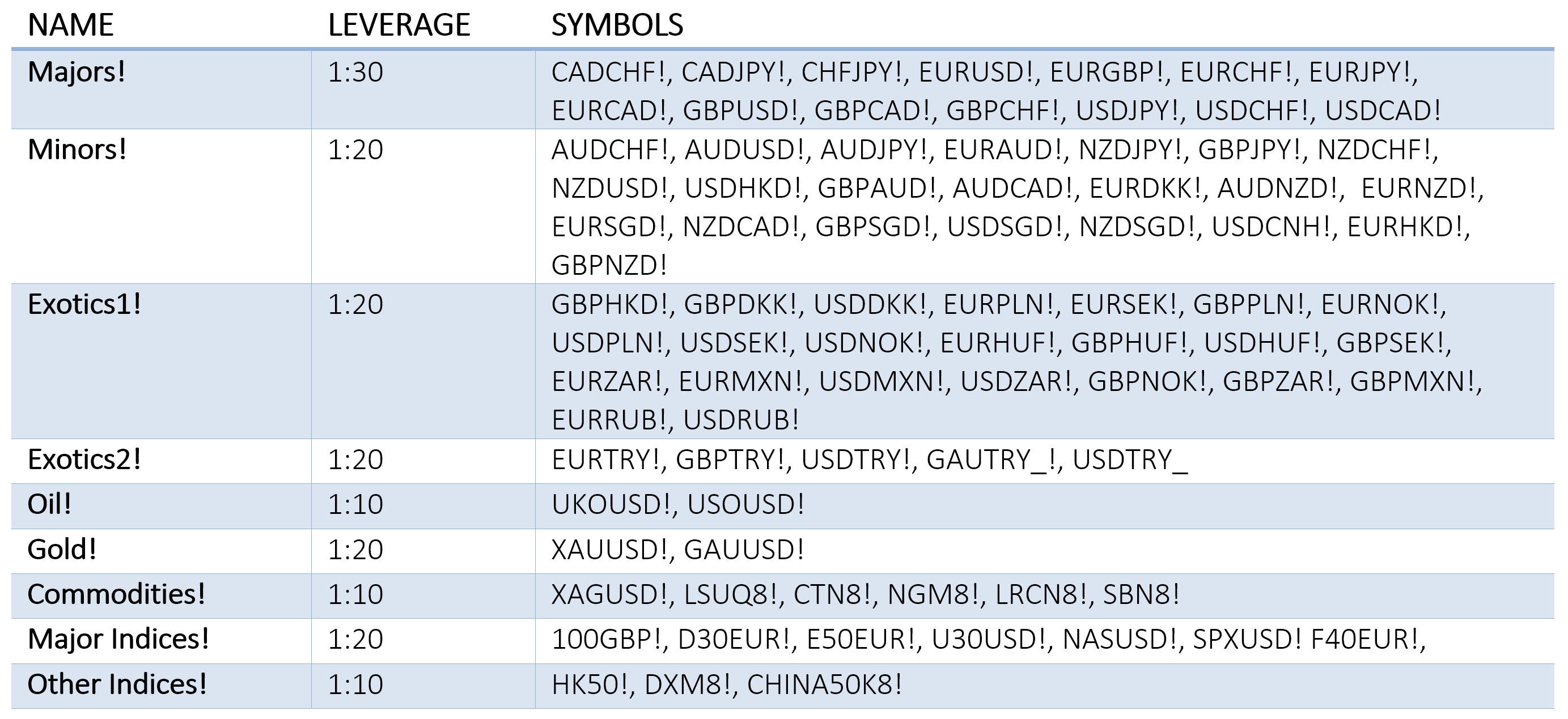

Leverage Levels after 1st August 2018 (retail clients):

Other Terms after 1st of August 2018 (retail clients):

- A margin close out rule on a per account basis. This will standardise the percentage of margin (at 50% of minimum required margin) at which providers are required to close out one or more retail client’s open CFDs;

- Negative balance protection on a per account basis. This will provide an overall guaranteed limit on retail client losses. This means that retail client account balance will never be allowed to go below zero, regardless of market conditions.

- A restriction on the incentives offered to trade CFDs.

Positions after 1st of August 2018 (professional clients)

All existing symbols will be close-only starting from 1 Aug, implying that clients will only be able to close their existing positions but will not be able to open new positions with the existing symbols

New symbols will be defined in the system. Starting from 1 Aug, all new positions will be traded with new symbols. We will add “!” to each symbol to indicate it is a new symbol (such as EURUSD symbol will be EURUSD!).

There could be slight changes to mark ups as security groups will change along with new symbols and new leverages. Clients are encouraged to email customer services to learn their new mark ups based on new security groups, compared to old mark ups.

TALK TO US

Any questions about TeraFX pro account?

Call us on: 020 70730493

E-mail: customerservices@terafx.co.uk

FAQ

The European Securities and Markets Authority (ESMA) has now published its final decision that it will be limiting the leverage available to retail clients to between 30:1 and 2:1, and CFD products are considered high risk and complex, and higher leverage rates are not suitable for the majority of retail clients. These restrictions take effect on 1 August 2018 but won’t apply to TeraFX Pro clients, who are classified as ‘professional clients’.

CFD restrictions apply to all retail clients of regulated brokers in the UK and EU. Beware; if a broker promises you high leverage and you are a retail client with that broker, it is likely this broker in not regulated and/or based outside EU.

The product intervention measures ESMA has adopted under Article 40 of the Markets in Financial Instruments Regulation include:

- Leverage limits on the opening of a position by a retail client from 30:1 to 2:1, which vary according to the volatility of the underlying:

- 30:1 for major currency pairs;

- 20:1 for non-major currency pairs, gold and major indices;

- 10:1 for commodities other than gold and non-major equity indices;

- 5:1 for individual equities and other reference values;

- 2:1 for cryptocurrencies;

- A margin close out rule on a per account basis. This will standardise the percentage of margin (at 50% of minimum required margin) at which providers are required to close out one or more retail client’s open CFDs;

- Negative balance protection on a per account basis. This will provide an overall guaranteed limit on retail client losses;

- A restriction on the incentives offered to trade CFDs; and

- A standardised risk warning, including the percentage of losses on a CFD provider’s retail investor accounts.

There is no change to the tax status of the products we provide to our professional clients.

TeraFX is a regulated broker and adheres to EU and UK regulations for retail clients’ protection.

Although reduced leverage from 1st Aug 2018 will apply, you as a retail client of TeraFX can still trade variety of CFDs via one of the best regarded platforms on the market - MT4. You will also have retail clients’ protections, to include:

- 50% margin close out rule on an account level basis,

- negative balance protection on an account level basis

- client money segregation.

You are also eligible for Financial Services Compensation Scheme protection on up to £50,000 that you hold with us. As an individual, you are able to use the Financial Ombudsman Service if you aren’t satisfied with the outcome of a complaint to us. Your client money will not be segregated from our funds. You also have the right to request a different categorisation at any time, for example if you want a higher level of regulatory protection.

As a professional client of TeraFX, you won’t be subject to the same leverage restrictions as retail clients. Higher leverage can amplify losses. Your client money will not be segregated from our funds and could be affected in the event of our insolvency. We won’t provide you with the current risk warnings we provide to retail clients, or any standardised risk warning that is introduced in future in relation to transactions in complex financial products. Certain FCA (or equivalent) rules relating to the form and content of information provided by TeraFX do not apply, including those relating to communications and financial promotions. Retail clients will benefit from negative balance protection being introduced. However, this functionality will not be available for TeraFX professional clients.

In order to act in the best interest of its clients, TeraFX will maintain existing positions of its retail clients opened before the 1st of August 2018 on current leverage until such positions are closed by each respective client (“Existing positions”). Retail clients’ positions opened on or after the 1st of August 2018 will be opened with new leverage levels in compliance with the Measures (“New positions”). In addition, TeraFX will maintain stop out levels as they are currently for Existing positions; for New positions, TeraFX will set a stop out level at 50%.

In order to qualify to become a Professional Client, you will need to meet at least 2 out of the 3 eligibility criteria outlined by the FCA. There will be no change to tax status or any additional cost to change to Professional Client status.

The criteria are as follows:

Trade size & Volume

You have traded, in significant size, in the spread bet/forex/CFD markets or other leveraged products (e.g. indices, shares, spot FX, futures, options, other derivatives etc.) at an average frequency of 10 transactions per quarter over the previous four quarters (with TeraFX and/or other providers).

Size of portfolio

The size of your financial instrument portfolio, defined as including cash deposits and financial instruments, exceeds EUR 500,000 (or equivalent in your local currency).

Acceptable examples of savings and investments: Cash savings, stock portfolio, stocks and shares ISA, trading accounts, mutual funds, SIPP (excluding non-financial instruments).

Unacceptable examples of savings and investments: Company pension, non-tradable assets, property, luxury cars, jewellery.

Professional Experience

You work or have worked in the financial sector for at least one year in a professional position, which requires knowledge of the transactions or services envisaged.

Check TeraFX Classification Policy for more details or contact us via customerservices@terafx.co.uk

English

English 中文

中文 Русский

Русский Español

Español العربية

العربية اردو

اردو ไทย

ไทย